Interim results for the six months ended 30 June 2025

Delivering broad-based revenue growth, margin expansion & double-digit EPS growth

London, UK, 29 July – Convatec, a leading medical products and technologies company, announces its interim results for the six months ended 30 June 2025.

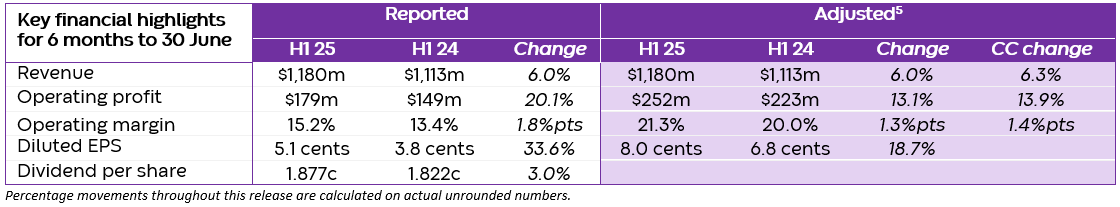

H1 25 financial highlights

- Organic revenue growth excluding InnovaMatrix® 6.8% (including InnovaMatrix® 6.0%1; reported 6.0%)

- Adjusted operating margin2 up c.130 bps to 21.3% (c.140 bps YoY in constant currency)

- 19% adjusted diluted EPS2 growth; 34% reported diluted EPS growth

Broad-based organic revenue growth across categories, geographies and products

- AWC4: 4.3%1 ex-InnovaMatrix®, led by a growing contribution from ConvaFoamTM, and further Aquacel® Ag+ ExtraTM growth. InnovaMatrix® (c.3% of Group revenue) decreased by 13%, in line with our expectations

- OC4: 4.7%1 supported by new patient starts in the US, Esteem BodyTM launch and growth in GEM

- CC4: 6.7%1 driven by volume growth in the US, excellent customer service and accelerating international sales

- IC4: 14.1%1 with strong demand for infusion sets in both diabetes and non-diabetes treatments

Successful new product launches

Our innovation pipeline is targeted at the fastest growing market segments:

- In AWC, ConvaFoamTM delivered high success rates in new customer product evaluations

- In AWC, we achieved EU and UK regulatory approval for ConvaNioxTM, our highly innovative advanced wound dressing powered by nitric oxide. Initial market launches are planned for Europe in H2 25

- In OC, we saw continued positive customer response to Esteem BodyTM which is winning segment share

- In CC, our compact catheter GentleCath AirTM for Women is also winning segment share

- In IC, we continued to diversify customers and applications, and saw our fastest organic growth from new customers, products and therapies, particularly NeriaTM Guard for AbbVie’s Parkinson’s treatment

Confident in FY25 outlook; on-track to deliver medium-term targets

- Group organic revenue growth excluding InnovaMatrix® of 5.5%-7.0% (unchanged) driven by our broadening product portfolio and focused commercial execution. InnovaMatrix® revenue of at least $75m3 (unchanged)

- Adjusted operating margin2 of 22.0-22.5% (unchanged), despite c.(50) bps of headwinds from FX and anticipated tariffs in FY25

- Another year of double-digit growth in adjusted EPS2, with at least 80% cash conversion (unchanged)

- On-track to consistently deliver medium-term targets for 5-7% organic revenue growth and reach mid-20s% adjusted operating margin2 by 2026 or 2027 (unchanged)

Karim Bitar, Chief Executive Officer, commented:

“Convatec performed strongly in the first half and we are on track to deliver FY25 financial guidance. Under our FISBE strategy, we saw further broad-based organic revenue growth across all chronic care categories, further operating margin expansion and double-digit growth in adjusted EPS.

“Looking ahead, we are well-positioned to deliver our medium-term targets, including double-digit compound annual growth in EPS and free cash flow to equity. This will be driven by our leading positions in structurally growing markets, strongest-ever innovation pipeline and clear focus on execution excellence by our dedicated team of over 10,000 colleagues worldwide.”

H1 25 financial summary

- Adjusted operating margin2 of 21.3%, up c.130 bps YoY (c.140 bps in constant currency)

- Adjusted operating profit2 up 13% to $252m. Reported operating profit up 20% to $179m (H1 24: $149m)

- Adjusted EPS2 increased 19% to 8.0 cents. Net finance costs down $8m YoY to $32m and adjusted tax rate of 24.0% (H1 24: 23.7%). Reported EPS increased 34% to 5.1 cents (H1 24: 3.8 cents)

- Free cash flow to equity5 of $58m (H1 24: $57m)

- Equity cash conversion5 of 35% (H1 24: 41%), reflecting the normal timing of working capital cashflows which are expected largely to reverse in H2 25

- Net debt to adjusted EBITDA ratio of 1.9x (H1 24: 2.3x), after $101m in dividends, $69m capex, $26m M&A and $80m working capital (H1 24: $75m)

Category growth expectations and additional FY25 guidance

- Category revenue growth guidance is unchanged for AWC, OC and CC. We are increasing full year IC revenue guidance to double-digit after a strong first half:

- AWC4: mid-single digit growth excluding InnovaMatrix® 3. InnovaMatrix® revenue of at least $75m3

- OC4: mid-single digit growth

- CC4: mid-to-high single digit growth

- IC4: double-digit growth (previously high-single digit growth)

- Net finance costs now expected to be $65-70m (previously $70-75m; 2024: $78m). Adjusted book tax rate is expected to be similar to FY24 at c. 24%, with the cash tax rate again materially lower

- Reflecting ongoing investments in innovation and efficiency programmes, continue to expect capex of $130-150m, opex R&D spend of c.$100-110m and cash costs of adjusting items of c.$20m

Investor and analyst presentation

The results presentation will be held at 09:45hrs (UK time) today. The event will be simultaneously webcast and the link can be found here. The full text of this announcement and the presentation for the analysts and investors meeting can be found on the ‘Results, Reports & Presentations’ page of the Convatec website www.convatecgroup.com/investors/reports

Scheduled events

|

Trading update for the 10 months ending 31 October 2025 |

13 November 2025 |

|

FY25 preliminary results |

25 February 2026 |

Dividend calendar

|

Ex-dividend |

21 August 2025 |

|

Record date |

22 August 2025 |

|

Payment date |

1 October 2025 |

About Convatec

Pioneering trusted medical solutions to improve the lives we touch: Convatec is a global medical products and technologies company, focused on solutions for the management of chronic conditions, with leading positions in Advanced Wound Care, Ostomy Care, Continence Care, and Infusion Care. With more than 10,000 colleagues, we provide products and services in around 90 countries, united by a promise to be forever caring. Our solutions provide a range of benefits, from infection prevention and protection of at-risk skin to improved patient outcomes and reduced care costs. Convatec's revenues in 2024 were over $2 billion. The company is a constituent of the FTSE 100 Index (LSE:CTEC). To learn more please visit http://www.convatecgroup.com

Contacts

Investor Relations: IR@convatec.com

Media: MediaRelations@convatec.com

(1) Organic growth is calculated by applying the applicable prior period average exchange rates to the Group's actual performance in the respective period and excluding acquired and disposed/discontinued businesses. Acquisitions and disposals added 30 bps to constant currency growth in H1 25

(2) Consistent with prior years, management present adjustments to the reported figures to produce more meaningful measures in monitoring the underlying performance of the business.

(3) In November 2024, Medicare Administrative Contractors published Local Coverage Determinations (LCDs) for Skin Substitute Grafts/Cellular and Tissue-Based Products for the Treatment of Diabetic Foot Ulcers (DFU) and Venous Leg Ulcers (VLU). Convatec’s InnovaMatrix® was not covered by Medicare for DFU/VLU treatments in the LCDs. The LCDs were then postponed until 1 January 2026, and as announced in our statement of 14 April 2025, this improved the FY25 outlook for InnovaMatrix®.

(4) AWC is Advanced Wound Care; OC is Ostomy Care; CC is Continence Care and IC is Infusion Care.

(5) Certain financial measures in this document, including adjusted results, are not prepared in accordance with International Financial Reporting Standards (IFRS). All adjusted measures are reconciled to the most directly comparable measure prepared in accordance with IFRS in the Non-IFRS Financial Information

Press Release